Actively Managed Certificate

A Swiss Based Fully Compliant Fund

Steady Growth with Peace of Mind

Secure, Stable & Market Resilient

80/20 Split

A clear and investor favouring profit distribution model.

Upon generating profits, an 80/20 split is applied, with the investor enjoying 80% of the gains, motivating the Fund to strive for superior performance.

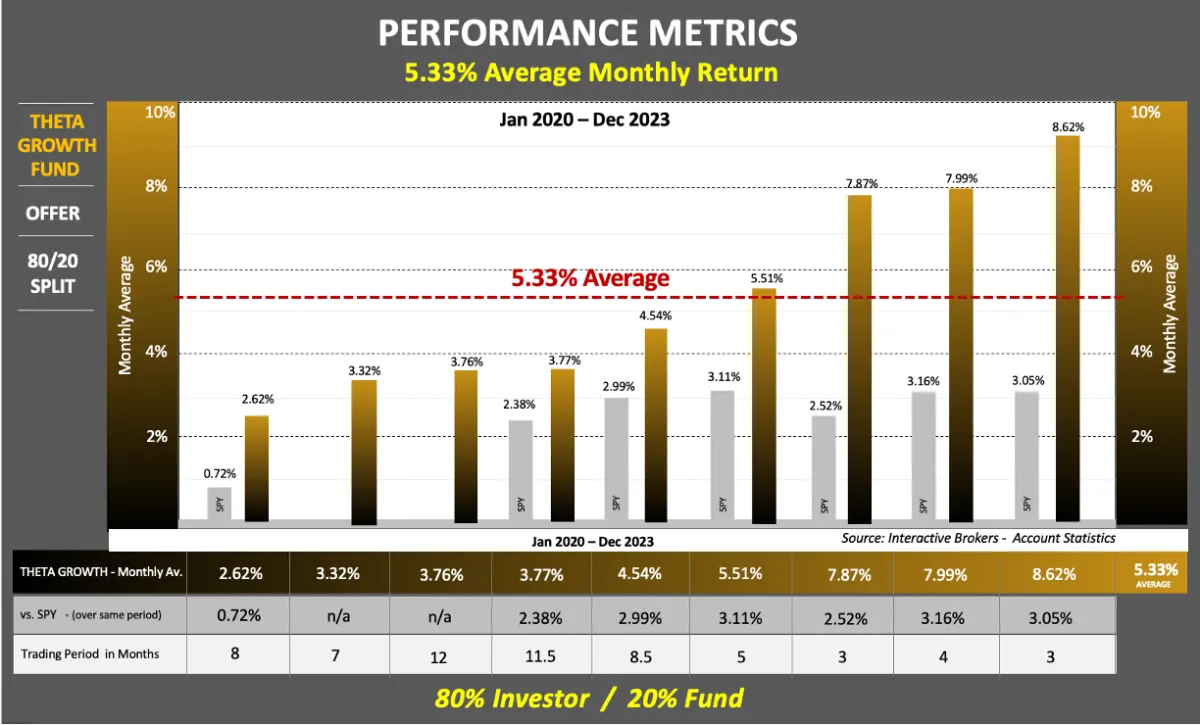

The track record over recent years

has been 30%+ per annum return

ABOUT US

Outcome Focused - Client Centric

The objective of Theta Growth Fund is to deliver consistent capital growth - increasing the wealth of our Clients.

Our Clients are

Discerning investors who understand the potential of high returns through expert options trading

Seeking exceptional returns with managed risk

Knowledgeable to appreciate sophisticated trading strategies that harness the power of theta discrepancies for profit maximisation.

SERVICES

We Have Consistently Outperformed The Markets

Maximise Your Profits

This is a Fully Compliant Investment Structure

Our mission is to help you achieve maximum profits through the inbuilt safety within our unique strategies, expertise and service.

5.33% Average Monthly Returns = 60%+ p.a.

Investment returns are not left to chance. Our trading strategy is the result of decades of refinement, leveraging proven algorithms and enhanced with cutting edge technology. We prioritise the safety of your investment through dynamic hedging, striking the perfect balance between aggressive growth and prudent risk management.

Stability in an Unpredictable Market

While markets fluctuate and indices like the S&P 500 experience volatility, our results have stood firm.

Our trading strategy has proven resilient, remaining steadfast and unaffected by downturns, providing a harbour of reliability in the stormy seas of the market.

Alignment of Interests

Our profit sharing arrangement is designed to align the fund's interests with those of our investors. The fund's earnings are directly correlated with investor success, creating a partnership that thrives on mutual profitability and trust.

Performance Metrics That Matter

For the analytical mind, our performance speaks volumes. The Sharp Ratio, a measure of risk adjusted return, stands impressively between 1.68 and 1.84. the Sortino ratio, distinguishing harmful volatility from total overall volatility, ranges between 2.80 and 2.84, underscoring our exception performance in favourable and unfavourable conditions alike.

You, the informed investor, know the challenge of finding an investment that offers high interest without compromising security. We invite you to join the ranks of those who no longer have to choose. With our Theta Capital Growth, embark on a journey where robust returns and security are not mutually exclusive but a standard.

Join us. We are experts in this field. Watch your capital grow with Theta Capital Growth.

Get In Touch

Reach out to us with any inquiries regarding Theta Growth Fund.